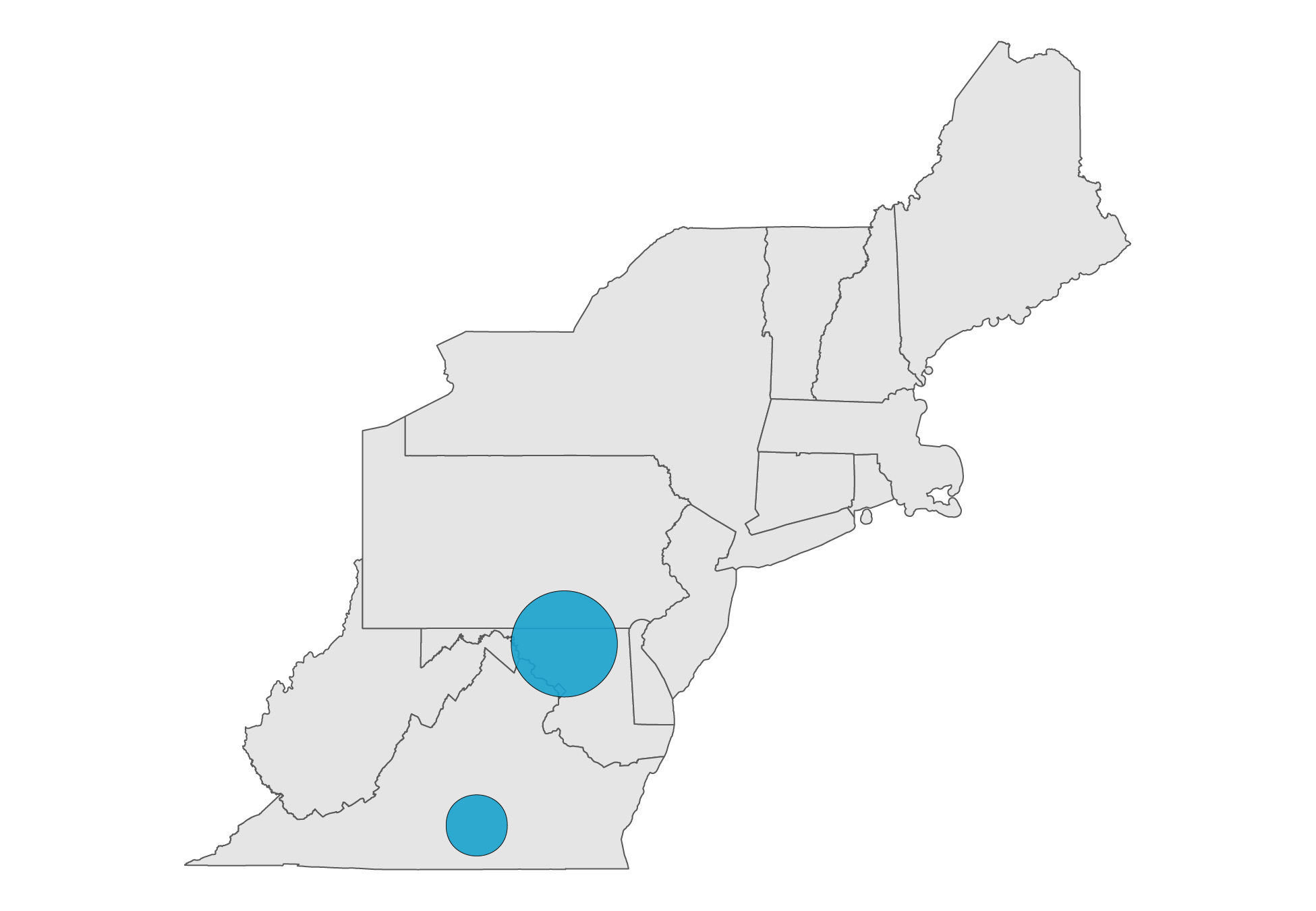

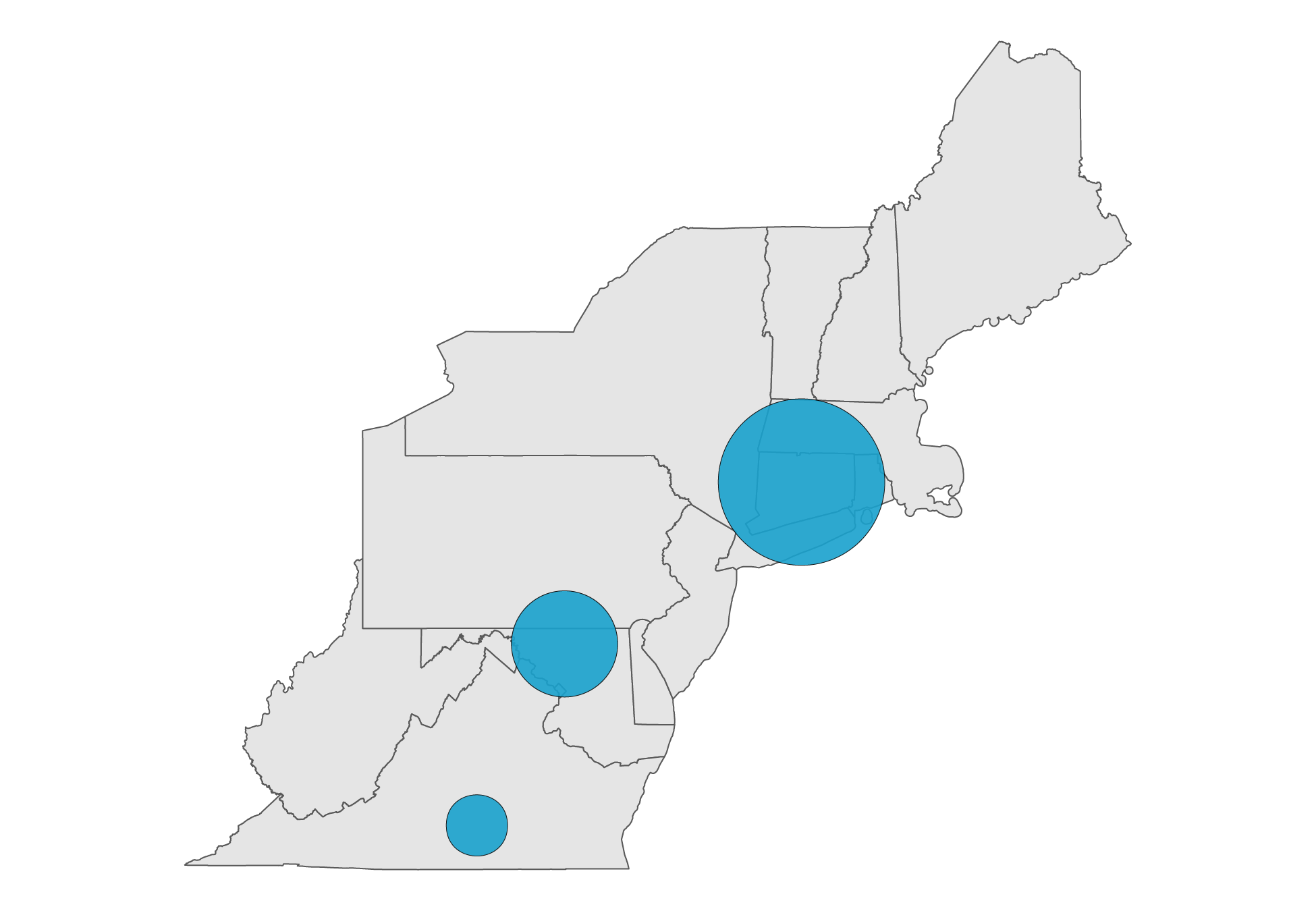

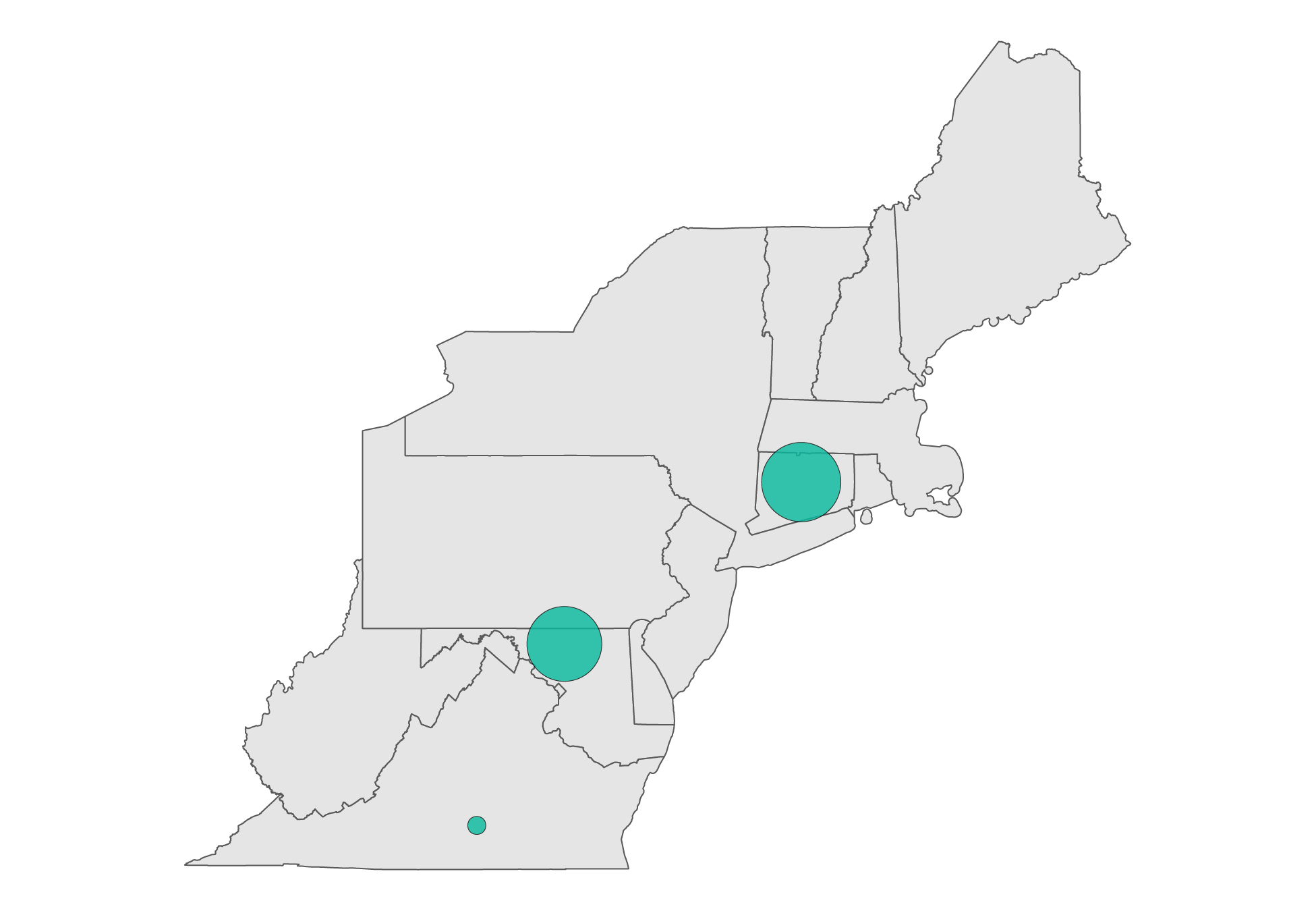

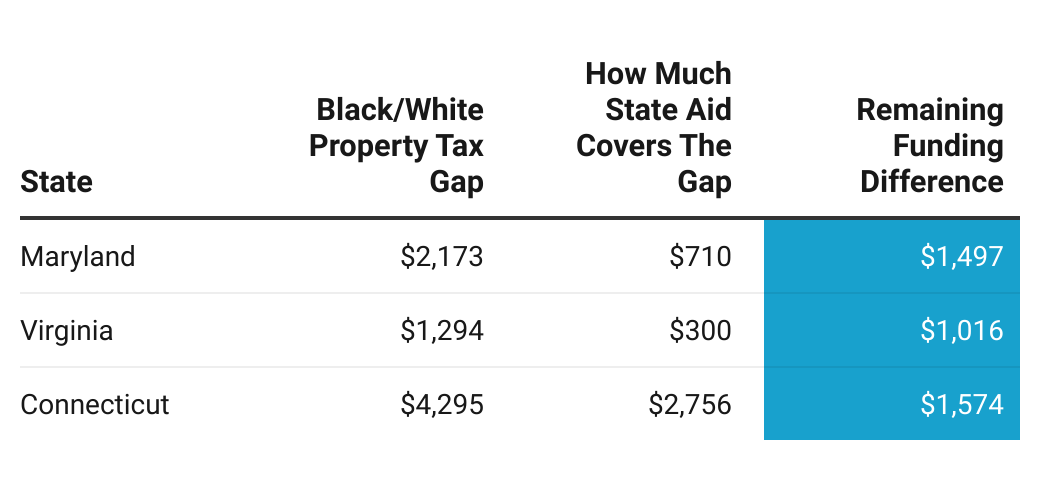

In Virginia in 2018, the average property tax revenue per child was $1,016 more for White children than for Black children.

In Maryland, White children got $1,497 more in property taxes to fund their education.

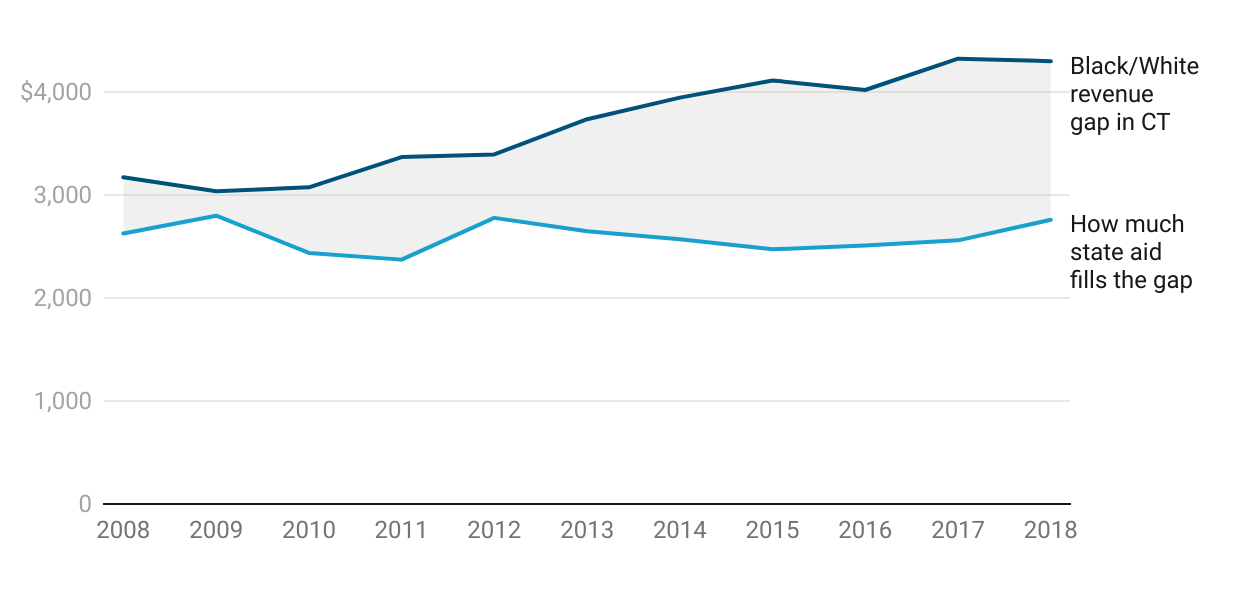

In Connecticut, White children got $4,295 more.

When state funding is taken into account, the disparity between Black and White students shrinks somewhat.

Yet in Connecticut, that disparity actually got worse over a 10-year period.

Professors Preston Green, Bruce Baker, and Joseph Oluwole argue that states should commit to filling the Black/White funding gap as a form of reparations for historic discrimination patterns in housing and education.

"These corrections are past due," they write, "and race neutral alternatives are insufficient."